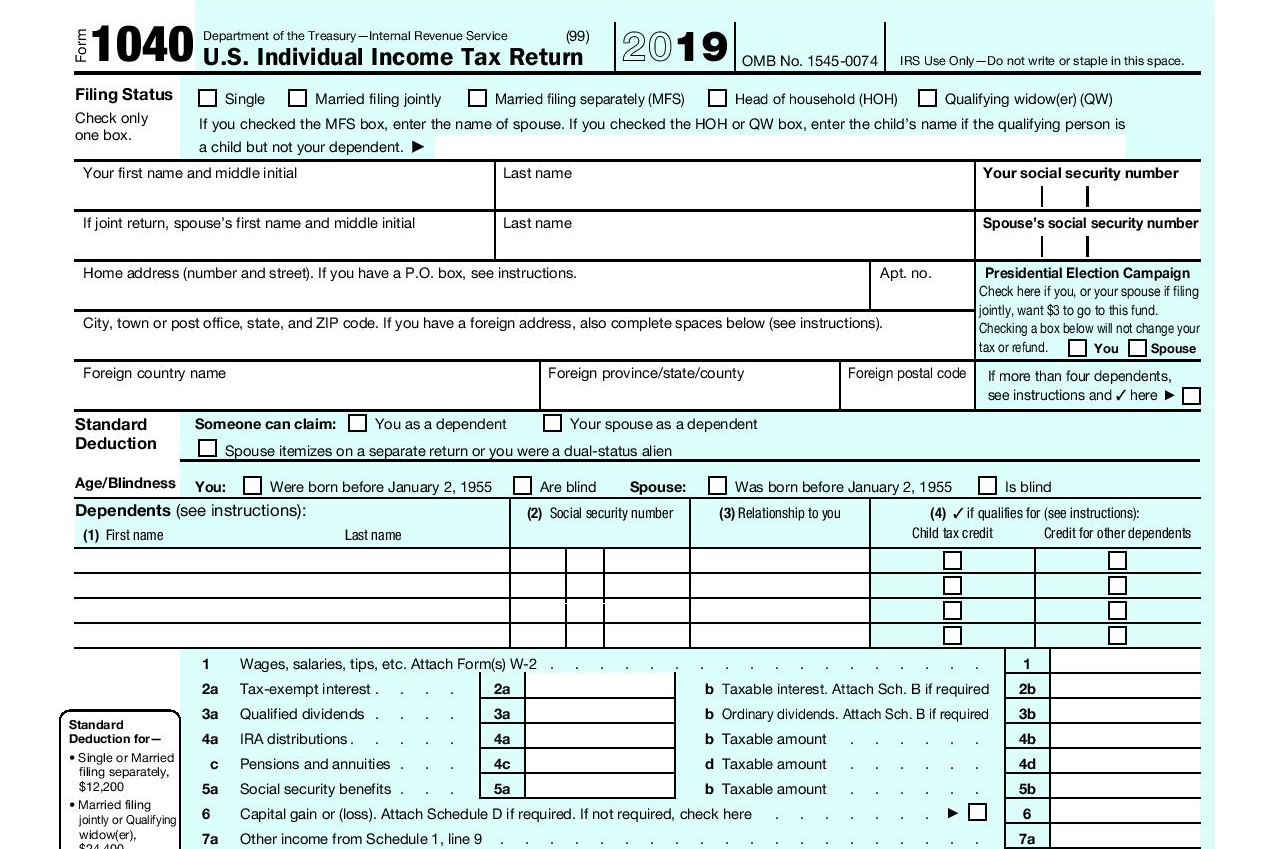

In the entry space next to line 8z you would write “Form 1099-K Personal Item Sold at a Loss - $700.” See the instructions for line 24z. For example, you bought a couch for $1,000 and sold it through a third-party vendor for $700, which was reported on your Form 1099-K. In the entry space next to line 8z write “Form 1099-K Personal Item Sold at a Loss” and also enter the amount of the sale proceeds.

If you report the loss on line 8z, enter the amount of the sale proceeds from Form 1099-K on line 8z.

If you sold a personal item at a loss, either report the loss on Form 8949 or report it on line 8z.

On page 87, the text for Line 8z, under Form 1099-K loss reportinghas been revised to read:. If, in 2022, you disposed of any digital asset, which you held as a capital asset, through a sale, trade, exchange, payment, gift, or other transfer, check “Yes” and use (a) Form 8949 to calculate your capital gain or loss and report that gain or loss on Schedule D (Form 1040) or (b) Form 709 in the case of gifts. On page 15, the text under How To Report Digital Asset Transactionshas been revised to read:. If you downloaded or printed the 2022 Instructions for Form 1040 (and 1040-SR) prior to January 20, 2023, please be advised that the instructions for reporting digital asset transactions and the instructions for Form 1099-K loss reporting have been revised.

0 kommentar(er)

0 kommentar(er)